Influencer marketing has become a powerful tool for financial brands looking to reach new audiences and build their reputation online. With the rise of social media platforms like Instagram, YouTube, and TikTok, influencers have become an increasingly popular way for brands to promote their products and services. However, building a successful influencer marketing strategy can be challenging, especially in the financial industry, where regulations are strict, and consumer trust is paramount.

In this article, you will learn how to build a successful influencer marketing strategy for financial brands. We will cover everything from identifying your target audience to developing a content strategy and measuring your results. By the end of this post, you will have the knowledge and tools you need to create a successful influencer marketing campaign that helps build trust and credibility with your target audience.

Must Read: Google Ads and Shopify Agency

Why should financial brands use influencer marketing?

Financial brands should use influencer marketing to reach a wider audience and build trust with potential customers. Influencers have established themselves as trusted sources of information and recommendations for their followers, making them valuable partners for financial brands seeking to establish credibility in their respective industries.

Influencer marketing can also help financial brands break through the noise of traditional advertising methods. By working with influencers with a significant following on social media platforms like Instagram or YouTube, financial brands can leverage their influence to promote products or services directly to potential customers in an organic way.

Influencer marketing allows financial brands to showcase their offerings in real-life scenarios. For example, an influencer could create content showcasing how they use a particular bank's mobile app or investment platform while traveling abroad. This type of content highlights the brand's offerings and shows how they can be used in practical situations – ultimately increasing the likelihood that viewers will become customers.

What are the benefits of Influencer Marketing for Financial Brands?

One of the main benefits of influencer marketing for finance brands is that it allows them to tap into niche audiences. By working with influencers in specific areas like personal finance or investing, financial brands can target the right audience for their products and services. Moreover, influencers are trusted sources of information for their followers. Therefore, recommending a particular financial product or service carries more weight than traditional advertising methods.

Another benefit of influencer marketing for finance brands is the ability to create engaging content that resonates with their target audience. Influencers know how to create authentic content that connects with their followers better than anyone else. It means that finance brands can leverage this expertise to create compelling campaigns that capture the attention of potential clients and generate leads for future business growth.

a. Reach

One of the key benefits of influencer marketing for financial brands is the ability to reach a wider audience. Influencers have large followings on social media platforms, and partnering with them can give financial brands access to their followers. It can be especially beneficial for financial brands trying to reach younger audiences who may not respond well to traditional advertising methods.

Another benefit of influencer marketing is building trust and credibility with consumers. Many influencers have built strong relationships with their followers based on shared interests or values, and partnering with them can help financial brands tap into that trust. When an influencer promotes a financial brand, it can lend legitimacy and credibility to that brand in the eyes of their followers.

In addition, influencer marketing allows financial brands to target specific niches within their audience. By partnering with influencers specializing in a particular area – such as personal finance or investing – brands can more effectively reach those most likely interested in their products or services. This targeted approach can result in higher engagement rates and ultimately lead to more conversions for the brand.

b. Tapping into a wider audience

Influencer marketing is one of the most effective ways to tap into a wider audience. This type of marketing involves partnering with individuals with a large following on social media platforms such as Instagram, Twitter, or YouTube. These influencers can help spread your message to their followers and increase brand awareness.

Financial brands can benefit significantly from influencer marketing. By partnering with influencers in the financial space, they can reach an audience interested in personal finance and investing. These influencers can create content that educates their followers about the benefits of using financial services such as savings accounts, credit cards, and investment platforms.

In addition to reaching a wider audience, influencer marketing can help financial brands build trust with their target market. When an influencer endorses a particular product or service, it adds credibility to the brand and creates a sense of trust between the consumer and the company. It is significant for financial brands that deal with sensitive information such as banking details or investments.

c. Credibility

Credibility is among the most essential factors in influencer marketing for financial brands. In an industry where trust and reputation are everything, partnering with influencers with a strong and credible voice can help build trust among potential customers. Influencers with experience in the finance or business industry or a proven track record of making sound financial decisions can lend valuable credibility to a brand.

Another benefit of working with credible influencers is their ability to provide educational content to followers. Financial brands can work with influencers to create informative and engaging content that educates consumers on essential topics such as investing, budgeting, and retirement savings. It positions the brand as an authority in the industry and helps establish the influencer as a trusted source of information.

Finally, partnering with credible influencers can help financial brands reach new audiences. Financial brands can expand their reach beyond traditional marketing channels by working with influencers who have established themselves as thought leaders within their niche market or demographic group. This approach allows them to tap into new customer segments that may be harder to reach through conventional advertising.

d. Establishing trust and expertise

Trust and expertise are crucial for financial brands in the highly competitive market. Influencer marketing can help these brands build credibility and effectively reach their target audience. By partnering with influencers well-respected in the finance industry, brands can leverage their authority to gain the trust of their followers.

Influencers offer unique insights that resonate with their followers, which can increase brand awareness and improve engagement rates. They also have a loyal following, meaning they already have established trust with their audience. Financial brands can benefit greatly by tapping into this existing trust to establish themselves as experts in the industry.

Furthermore, working with influencers specializing in certain areas of finance, such as investments or cryptocurrency, allows financial brands to showcase their expertise on specific topics. It helps them to position themselves as thought leaders in these areas and attract new customers interested in those services. Overall, influencer marketing offers a valuable opportunity for financial brands to establish themselves as trusted authorities and reach a broader audience within the industry.

e. Engagement

Engagement is a crucial aspect of influencer marketing. It refers to the level of interaction and involvement an audience has with an influencer's content or brand. Engaged followers are more likely to trust and act on recommendations from their favorite influencers, making them prime targets for financial brands looking to market their products or services.

One key benefit of influencer marketing for financial brands is increased engagement. By partnering with influencers with a strong following and engaged audience, financial brands can reach potential customers more authentically and effectively. Given the complex nature of financial products, it is essential which can be challenging to understand without expert guidance.

Another benefit of influencer marketing for financial brands is improved brand perception. By associating their brand with trusted influencers, financial companies can enhance their image as credible and reliable sources of information. It can help build trust with potential customers, making it easier for them to make informed decisions about their finances. Overall, engagement through influencer marketing can be a powerful tool for building awareness, driving conversions, and increasing customer loyalty for financial brands.

Fostering meaningful connections with customers

In today's digital age, Influencer Marketing has become an effective way for financial brands to connect with their target audience. By partnering with influencers with a robust financial industry following, these companies can reach a wider audience and foster meaningful connections with potential customers. Influencers can share their experiences and insights about a particular financial product or service, which can help build consumer trust.

One of the main benefits of influencer marketing for financial brands is that it helps to increase brand awareness. With the help of influencers, these companies can reach new audiences who may not have been aware of them before. Additionally, influencer marketing allows financial brands to tap into the social media networks of their target audience and engage with them on a more personal level.

Another advantage is that it helps to create authentic content that resonates with customers. Instead of relying solely on traditional advertising methods, influencer marketing allows companies to create more genuine and relatable content. This approach is particularly effective when trying to build trust around complex financial products or services. Overall, by fostering meaningful connections through influencer marketing, financial brands can boost their brand image and drive sales and customer loyalty in the long run.

g. Cost-effective

One of the most significant benefits of influencer marketing for financial brands is that it can be a cost-effective way to reach a targeted audience. Traditional advertising methods like television or radio ads can be expensive and may not reach the desired demographic directly. However, partnering with an influencer who already has an engaged following in the financial industry can provide a more precise and effective way to connect with potential customers. In addition, influencer marketing allows financial brands to allocate their budget towards influencers who have proven success in engaging their followers and driving conversions. Instead of spending money on broad advertising campaigns, financial brands can focus on working with influential influencers within specific niches or communities.

Using influencer marketing as part of a larger marketing strategy for financial brands can help make the most out of limited budgets while still achieving high engagement rates and measurable results.

h. Maximizing ROI through targeted campaigns

Influencer marketing has become an increasingly popular strategy for financial brands looking to maximize their ROI through targeted campaigns. By partnering with influencers, these brands can tap into the influencer's existing audience and leverage their trust and credibility to promote their products or services. Influencers in the finance industry can range from personal finance bloggers to social media personalities who discuss investing, budgeting, and credit scores.

One of the main benefits of influencer marketing for financial brands is that it allows them to reach a highly targeted audience. Rather than casting a wide net with traditional advertising methods, influencers have already established themselves as experts in a particular niche within the finance industry. It means that their audience is likely made up of people interested in specific financial topics or actively seeking advice on managing their finances. Another benefit is that influencer marketing can help financial brands establish trust with potential customers. Many consumers are hesitant to trust traditional advertising messages from companies they don't know but are more likely to listen to recommendations from people they follow online. By partnering with trusted influencers, financial brands can position themselves as trustworthy resources for financial information and advice.

i. Compliance

Compliance is crucial to any financial brand's marketing strategy, especially regarding influencer marketing. Ensuring that all content influencers create follows industry regulations and guidelines is essential for maintaining the brand's reputation and avoiding legal consequences.

One benefit of influencer marketing for financial brands is that it allows them to reach new audiences through trusted sources. However, this must be done promptly, with proper disclosures and transparency about sponsored content. Brands must also ensure that they work with influencers with expertise and knowledge about the industry to avoid misleading information or advice.

Overall, compliance is an integral part of influencer marketing for financial brands. It helps them maintain their reputation and ensures consumers receive accurate information that can help them make informed decisions about their finances. By working with influencers who understand compliance requirements, financial brands can continue to leverage the power of influencer marketing while staying within regulatory guidelines.

j. Navigating regulatory frameworks with ease

Influencer marketing has become a popular promotional strategy in recent years, and financial brands are no exception. Financial brands can effectively reach their target audience and build brand awareness by partnering with influencers with a significant following on social media platforms like Instagram, YouTube, and TikTok.

One of the key benefits of influencer marketing for financial brands is that it allows them to humanize their brand. Financial products and services can often seem complex or intimidating to the average consumer. However, by working with relatable and approachable influencers, financial brands can help demystify their offerings and make them more accessible.

In addition to building brand awareness, influencer marketing can drive traffic to a financial brand's website or landing pages. Influencers typically include links or swipe-up features in their posts that direct followers to the promoted product or service. It not only increases website traffic but also generates leads for potential customers who may be interested in learning more about what the brand has to offer.

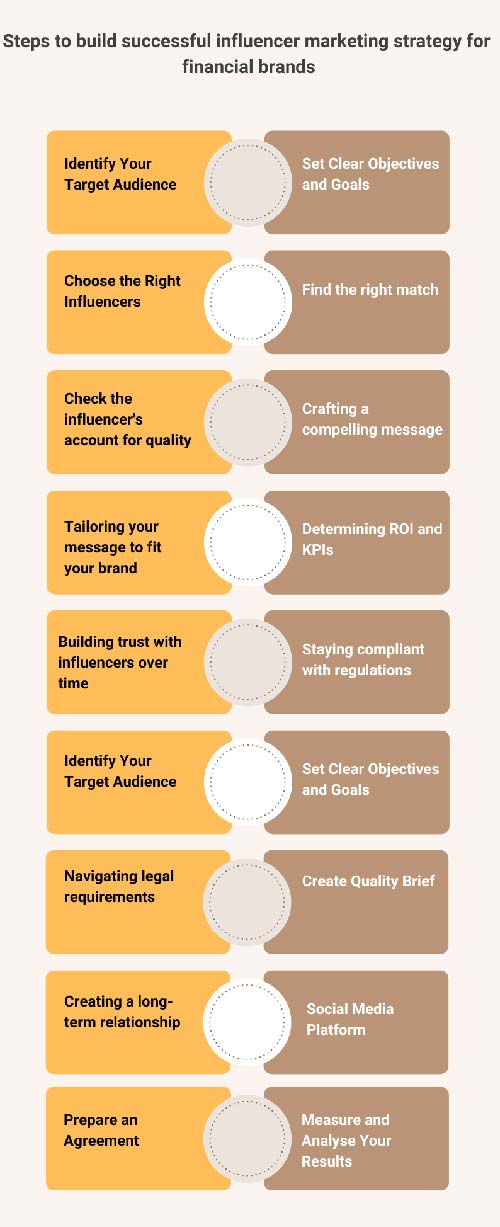

Steps to build successful influencer marketing strategy for financial brands

Identify Your Target Audience

The first step in building a successful influencer marketing strategy for financial brands is identifying your target audience. It will help you choose the right influencers to partner with and create content that resonates with your audience. To identify your target audience, consider the following:

Demographics

What is the age, gender, income, and education level of your target audience? Understanding the demographics of your target audience can help you choose the right influencers and develop content that speaks to their unique needs and interests.

Interests

What are the interests and hobbies of your target audience? Understanding the interests and hobbies of your target audience can help you create content that resonates with them and provides value.

Pain Points

What are the challenges your target audience faces when it comes to finances? Understanding the pain points of your target audience can help you create content that addresses their concerns and provides solutions.

Once you have identified your target audience, you can begin to research influencers who have a following that aligns with your target audience.

Set Clear Objectives and Goals

Before you begin your influencer marketing campaign, setting clear objectives and goals is essential. It will help you measure the success of your campaign and make adjustments as needed. Here are some common objectives and goals for influencer marketing campaigns:

Increase Brand Awareness

This objective aims to increase your brand's visibility and reach new audiences. To achieve this goal, you may want to create content promoting your brand and highlighting your unique value proposition.

Generate Leads

This objective aims to generate new leads and increase sales. You may want to create content promoting your products and services and providing a clear call to action to achieve this goal.

Build Trust and Credibility

This objective aims to build trust and credibility with your target audience. To achieve this goal, you may want to create educational content that provides valuable financial advice and solutions to common pain points.

Once you have set your objectives and goals, you can begin to develop a content strategy that aligns with your goals.

Develop a Content Strategy

Developing a content strategy is essential to the success of your influencer marketing campaign. Your content strategy should align with your objectives and goals and provide value to your target audience. Here are some content ideas for financial brands:

Educational Content

Educational content, such as financial tips and advice, can help build trust and credibility with your audience. By providing valuable information and solutions to common pain points, you can position your brand as a trusted financial information and advice source.

Product Reviews

Product reviews can help promote your products and services and provide social proof to your target audience. By partnering with influencers with a strong reputation and who can provide honest and unbiased reviews, you can increase the credibility and trust of your brand.

Sponsored Posts

Sponsored posts can help increase brand awareness and reach new audiences. By partnering with influencers with a highly engaged following, you can increase the reach and impact of your content and promote your brand to new audiences.

When developing your content strategy, ensuring that all content complies with financial regulations and guidelines is essential. It may require working closely with your legal and compliance teams to ensure that all content is accurate, transparent, and compliant with industry guidelines.

Choose the Right Influencers

Choosing the right influencers to partner with is crucial to the success of your influencer marketing strategy. When choosing influencers, consider the following:

Relevance

Does the influencer's content align with your brand values and message? Partnering with influencers who align with your brand values and can help promote your message effectively is essential.

Engagement

Does the influencer have a highly engaged following? Look for influencers with a highly engaged following, as this can help increase the reach and impact of your content.

Authenticity

Is the influencer authentic and transparent with their audience? Authenticity is crucial in the financial industry, as consumers seek trusted sources of information and advice.

In the financial industry, it is essential to partner with influencers with a strong reputation and can provide valuable financial advice to their audience. Look for influencers with a finance background, such as financial advisors, accountants, or economists.

Find the right match

Finding the right match for your brand is one of the most crucial steps in building a successful influencer marketing strategy. Identifying influencers who align with your brand values, target audience, and goals is essential. One way to do this is by conducting thorough research on potential influencers.

Start by analyzing their past collaborations and evaluating their content quality and engagement rate. Look for influencers with a genuine interest in your industry and whose followers are likely to be interested in your brand. Also, consider the influencer's personality and tone of voice to ensure they will represent your brand appropriately.

Another practical approach is to leverage influencer marketing platforms that connect brands with relevant influencers based on specific criteria such as niche, location, or audience demographics. These platforms often provide valuable insights into an influencer's performance metrics, allowing you to make data-driven decisions when selecting an influencer for partnership.

Ultimately, finding the right match requires careful consideration and research. By identifying influencers who align with your brand values and messaging, you can build long-lasting relationships that drive results for both parties involved.

Check the influencer's account for quality

One of the most significant aspects of influencer marketing is ensuring that the influencer you partner with has a quality account. The first step to check for quality is to look at their follower count and engagement rate. An authentic influencer will have an engaged audience interacting with their content regularly. If there is a large number of followers but little engagement, it may indicate that many followers are fake or purchased.

Another crucial element to consider when assessing an influencer's account is the relevance of their niche. It's essential to ensure that their area of expertise aligns with your brand's values and message so that your partnership feels genuine and not forced. Review the content they post across platforms like Instagram, Twitter, Facebook, and YouTube.

Lastly, examine how often they post on social media platforms and assess whether this matches up with your expectations for frequency in posting sponsored content if you decide to collaborate as part of your financial brand strategy. Considering these steps when choosing influencers for your financial brand marketing campaign can increase its overall success rate since you've ensured authenticity from each partner selected based on proven criteria.

Crafting a compelling message

A compelling message is crucial for financial brands looking to build a successful influencer marketing strategy. The first step in crafting a message that resonates with audiences is understanding the target audience's pain points and challenges. Once these have been identified, financial brands can develop solutions that speak directly to those needs. To create a compelling message, financial brands should focus on being clear and concise while delivering value to their audience. They must ensure that their messaging aligns with their brand image and values, which will help build trust with potential customers. Additionally, financial brands should consider incorporating storytelling techniques into their messaging, as this can be a powerful way to connect emotionally with audiences.

Ultimately, crafting a compelling message requires careful consideration of both the target audience's needs and the brand's values and identity. By doing so, financial brands can deliver messages that resonate with their audience while also establishing trust and credibility in influencer marketing.

Tailoring your message to fit your brand

When it comes to building a successful influencer marketing strategy for financial brands, tailoring your message is crucial. Your message should be consistent with your brand values and goals while resonating with your target audience. It means that you need to deeply understand your brand and the people you want to reach.

One way to tailor your message effectively is by using language that is easy for your audience to understand. Avoid using technical jargon or complex financial terms that might confuse them. Instead, use simple and straightforward language that they can easily relate to. Another way to tailor your message is by staying true to your brand voice. If you have a playful and lighthearted tone, make sure all your messaging reflects that same tone. Consistency in messaging helps create trust with consumers and build brand loyalty over time. When influencers share messages about their experience working with a financial company, their voice must match the overall tone of the campaign and the financial brand's corporate identity.

Determining ROI and KPIs

Determining ROI and KPIs is an essential part of any influencer marketing strategy. To determine your influencer marketing campaign's return on investment (ROI), you need to have clear expectations and goals in place. Whether it's increasing brand awareness or driving sales, tracking the success of your campaign against these goals will help you determine its effectiveness.

Key performance indicators (KPIs) are also essential to measure the success of your influencer marketing strategy. These metrics could include engagement rates, click-through rates, website traffic, and social media followers. By monitoring these KPIs throughout the campaign, you can quickly identify areas that require optimization or improvement.

In conclusion, determining ROI and KPIs requires a well-planned influencer marketing campaign with clearly defined goals and objectives. By monitoring key metrics throughout the campaign, financial brands can calculate their return on investment and track their progress toward achieving their desired outcomes.

Building trust with influencers over time

To establish a strong relationship, brands must take the time to understand the influencer's values, goals, and interests. It can be achieved by following them on social media, engaging with their content, and attending events they host or participate in.

Once a brand has identified the right influencers for its target audience, it must work to build trust through consistent communication and mutual respect. Brands should aim to provide value to the influencer beyond just compensation for sponsored posts. It could include access to exclusive products or events, promotion on the brand's social media channels or website, or opportunities for collaboration that benefit both parties.

Building trust with influencers takes time and effort but can lead to long-term partnerships that deliver substantial returns on investment. By prioritizing relationships over transactions and staying true to shared values and goals, brands can create lasting partnerships that drive brand awareness and growth.

Staying compliant with regulations

Compliance with regulations is crucial for financial brands when implementing influencer marketing strategies. Regulations vary from country to country and even state to state, so it's essential to research and ensure that the content published by influencers aligns with regulatory requirements.

One way of ensuring compliance is through contracts between the brand and influencers. These contracts should outline the expectations for both parties, including guidelines for compliance with relevant regulations. It's also vital to monitor influencer content regularly to ensure they are adhering to these guidelines.

Financial brands may also consider partnering with compliance experts or legal professionals who can provide guidance on regulatory requirements. By staying compliant with regulations, financial brands can avoid potential penalties while building trust among their audience.

Navigating legal requirements

Navigating legal requirements is essential when building a successful influencer marketing strategy for financial brands. Companies must adhere to various rules and regulations to ensure compliance with the law, protect their reputation, and avoid legal repercussions. For instance, financial brands must comply with regulations such as the Federal Trade Commission Act (FTC), which requires influencers to disclose any sponsored content.

Financial brands must also be aware of other legal considerations when working with influencers. It includes ensuring that all content is truthful and not misleading, avoiding any false or deceptive advertising claims, and respecting intellectual property rights such as copyrights and trademarks. Financial brands can build a successful influencer marketing strategy while mitigating potential risks by understanding these legal requirements and taking proactive steps to meet them.

In summary, navigating legal requirements is important in building a successful influencer marketing strategy for financial brands. Companies must comply with relevant laws and regulations such as the FTC Act while also being mindful of other legal considerations such as truthfulness in advertising and intellectual property rights. By doing so, they can effectively engage with influencers while minimizing risks associated with non-compliance or misconduct.

Create Quality Brief

A high-quality brief is crucial for the success of any influencer marketing campaign. It ensures that both the brand and the influencer are on the same page and sets clear expectations for the partnership. To create a great brief, start by outlining your goals for the campaign and identifying your target audience. Then, research potential influencers who align with your brand values and have an engaged following.

Next, communicate what you expect from the influencer regarding content creation, posting timelines, and any necessary disclosures or disclaimers. Please provide specific details on brand messaging or critical points to include in their posts. It's also essential to discuss compensation upfront to avoid any misunderstandings later on.

Lastly, establish a system for tracking and measuring results so that you can evaluate the success of the campaign against your initial goals. By creating a comprehensive brief covering all these bases, you set yourself up for a successful partnership with an influencer to help drive engagement and conversions for your financial brand.

Creating a long-term relationship

Creating a long-term relationship with influencers is crucial for the success of any influencer marketing campaign. One of the critical factors in building a long-term relationship is choosing the right influencer. Brands should look for influencers whose values align with their brand's image and who are genuinely interested in their products or services.

Communication is also essential in building a long-term relationship. Brands should maintain regular contact with influencers through email, social media, or messaging apps to inform them about upcoming campaigns and product launches. It is essential to provide clear guidelines on expectations and give feedback on content created by the influencer.

Finally, brands should invest in their relationships by offering incentives such as exclusive access to products, events, or discounts. It shows appreciation and encourages influencers to continue working with the brand over time. Building a deep connection with an influencer can increase trust between the brand and its audience, resulting in higher engagement rates and, ultimately, better ROI from your campaigns.

Social Media Platform

Choosing the right social media platform is essential when building a successful influencer marketing strategy for financial brands. Each platform's unique audience and features can make or break a campaign. For example, Instagram is great for visual content and reaching younger audiences, while LinkedIn is better suited for B2B marketing.

Another essential factor to consider is the type of influencer you want to work with. Some influencers may have more significant followings on specific platforms, so it's important to research which platforms they are most active on. Additionally, some influencers may be better suited for certain types of content – such as long-form blog posts on LinkedIn or short-form videos on TikTok.

Ultimately, choosing the right social media platform comes down to understanding your target audience and what type of content resonates with them. By researching and partnering with the right influencers on the right platforms, you can create an effective influencer marketing strategy that drives engagement and conversions for your financial brand.

Prepare an Agreement

One of the most important aspects of building a successful influencer marketing strategy for financial brands is preparing an agreement between the brand and the influencer. This agreement should outline all expectations, requirements, and compensation for both parties involved. It is essential to clearly understand what is expected from each party to avoid any misunderstandings or conflicts.

The agreement should include details such as the type of content that will be created, timelines for delivery, and any specific guidelines or restrictions that need to be followed. It should also clearly state how much compensation the influencer will receive and when payment will be made. Additionally, it’s essential to ensure that there are clauses in place for confidentiality and exclusivity if necessary.

Preparing a comprehensive agreement is crucial for building trust between financial brands and influencers. By setting clear expectations upfront, both parties can work together more effectively toward achieving their goals while minimizing potential risks or issues.

Measure and Analyze Your Results

Measuring and analyzing your results is crucial to the success of your influencer marketing campaign. It will help you identify what is working and needs to be adjusted. Here are some key metrics to measure:

Reach

It is the number of people who have seen your content. Reach can help you understand how many people are exposed to your brand and message.

Engagement

The number of likes, comments, and shares your content has received. Engagement can help you understand how your target audience interacts with your content and whether it resonates with them.

Conversions

Many people take action, such as signing up for a newsletter or purchasing a product. Conversions can help you understand how effective your content is at driving action and generating results.

By measuring and analyzing your results, you can adjust your content strategy and improve the success of your campaign. For example, if you notice that your educational content is performing well in terms of reach and engagement, you may want to focus more on this type of content in the future.

Risks and challenges to consider

One of the significant risks associated with influencer marketing for financial brands is the potential for a backlash from consumers. If an influencer promotes a product or service that ultimately turns out to be fraudulent or low-quality, the influencer and the brand may face significant reputational damage. It can result in lost revenue, legal action, and damage to future marketing efforts.

Another challenge that financial brands must consider when engaging in influencer marketing is maintaining compliance with regulatory requirements. Financial services are heavily regulated, and any advertising or promotional activities must comply with strict rules regarding disclosures, transparency, and fair business practices. Failure to meet these standards could result in regulatory fines and negative publicity.

Finally, financial brands need to select influencers who align with their values and messaging carefully. Working with influencers who do not share their business goals or ethics can communicate mixed messages to consumers. It can dilute brand messaging and make it difficult for customers to trust the company's offerings. Therefore, financial institutions must work only with reputable influencers whose values align properly with theirs.

Conclusion

In conclusion, building a successful influencer marketing strategy for financial brands requires careful planning and execution. By identifying your target audience, choosing the right influencers, setting clear objectives and goals, developing a content strategy, and measuring and analyzing your results, you can create a successful influencer marketing campaign that helps build trust and credibility with your target audience.

As the financial industry evolves, influencer marketing will become an increasingly important tool for financial brands looking to reach new audiences and build their reputation online. By following the steps outlined in this post, you can create a successful influencer marketing campaign that helps position your brand as a trusted source of financial information and advice. With the right strategy and execution, influencer marketing can help your brand achieve its marketing goals and drive business results.

Author Bio:

Shilpa Shah works in kalakar house. She likes to write about topics related to influencer marketing and social media. She is a content writer with more than two years of experience in the digital marketing field.